can i withdraw from my 457 without penalty

Non-Qualified Annuity and 72 q Distributions. Money saved in a 457 plan is designed for retirement but unlike 401 k and 403 b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half.

/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)

Are 457 Plan Withdrawals Taxable

Heres how you would calculate your withdrawal penalty.

. Penalty Account Balance x Interest Rate365 Days x Number of Days Interest. Money saved in a 457 plan is designed for retirement but unlike 401 k and 403 b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half. If you have a 457b but are not a government employee the rules are different.

Money saved in a 457 plan is designed for retirement but unlike 401k and 403b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half. 59 and a half years old. Under the Internal Revenue Code you can take money from a 457 early without paying the 10-percent early withdrawal penalty but youll still have to pay taxes on the money.

Penalty 10000 x 001365 x. Can I withdraw 457 plan. Money saved in a 457 plan is designed for retirement but unlike 401 k and 403 b plans you.

For non-qualified annuities only interest earned that is withdrawn is subject to this penalty and income taxes. You can withdraw your money from 457 before age 59½ without a 10 penalty unlike a 401k but you will owe taxes on any withdrawal. Is there a penalty for early withdrawals from a 457 plan.

Unlike other retirement plans under the IRC 457 participants can withdraw funds before the age of 59½ as long as you either leave your employer or have a qualifying hardship. You Can Max out Both a 457 and a Roth IRA If tax rates are a lot higher when you retire you will have significantly benefited from your Roth IRA because your withdrawals are tax-free. Unlike other tax-deferred retirement plans such as IRAs or.

When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 plan. Money saved in a 457 plan is designed for retirement but unlike 401 k and 403 b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half. Money saved in a 457 plan is designed for retirement but unlike 401k and 403b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half.

Unlike with 401 ks and 403 bs the IRS wont slap you with a penalty on withdrawals you make before age 59. Money saved in a 457 plan is designed for retirement but unlike 401k and 403b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half. However Section 72 q of the.

You are permitted to withdraw money from your 457 plan without any penalties from the Internal Revenue Service no matter how old you are. Ad Schedule an Appointment With Fidelity To Help Determine Your 457b Goals. However you will have to pay income taxes on the.

Ad Schedule an Appointment With Fidelity To Help Determine Your 457b Goals. Withdrawals from a 457 plan can be taken at any time without an IRS premature withdrawal penalty. You will however.

When can you withdraw from a 457 plan without penalty. I read that qualified first-time home buyers who will be living in the domicile as their primary residence may withdraw funds from their 457 b deferred compensation account. There is no penalty for early withdrawals but you must take a minimum distribution from age 72.

You have to pay a 10 additional tax on the taxable amount you withdraw from your SIMPLE IRA if you are under age 59½ when you withdraw the money unless you qualify for.

A Guide To 457 B Retirement Plans Smartasset

How To Calculate The Value Of Your Pension Pensions The Value Calculator

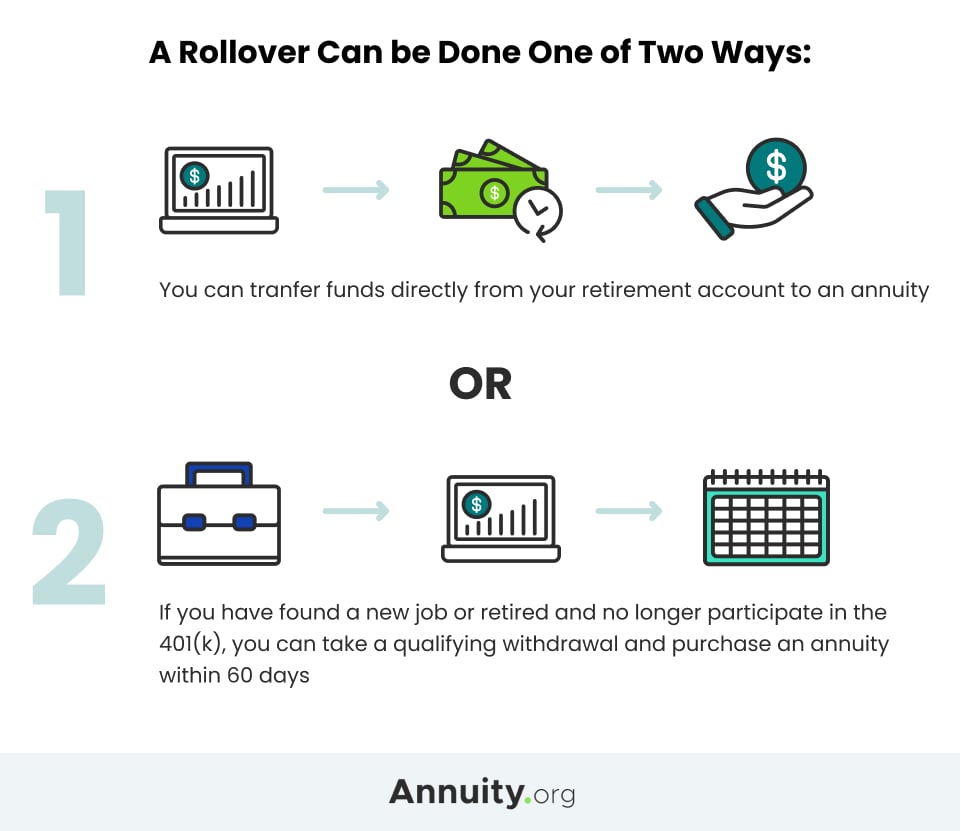

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Should You Take An In Service Non Hardship Withdrawal From Your Workplace Retirement Plan Frontier Wealth Management

Everything You Need To Know About 457 Plans Deferred Compensation

Irc 457 Early Withdrawal Guidelines

Are You Thinking Of Accessing Your Retirement Funds Due To Covid 19

Everything You Need To Know About 457 Plans Deferred Compensation

A Guide To 457 B Retirement Plans Smartasset

How A 457 Plan Works After Retirement

/GettyImages-1131086835-83fd238d51f44798943a4e69c1198537.jpg)

457 Plan Vs 403 B Plan What S The Difference

How A 457 Plan Works After Retirement

Everything You Need To Know About 457 Plans Deferred Compensation

Should You Pay Off Your Home With Retirement Funds Pros And Cons

Important Ages In The U S For Retirement Savings Withdrawals And Collecting Social Security Retirement Age Saving For Retirement Retirement

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

How To Access Retirement Funds Early Retirement Fund Investing For Retirement Early Retirement